Hailed as the biggest tax reform since India’s independence, GST will replace an array of central and state levies with a national sales tax, thereby creating a single market and making it easier to do business in the country.

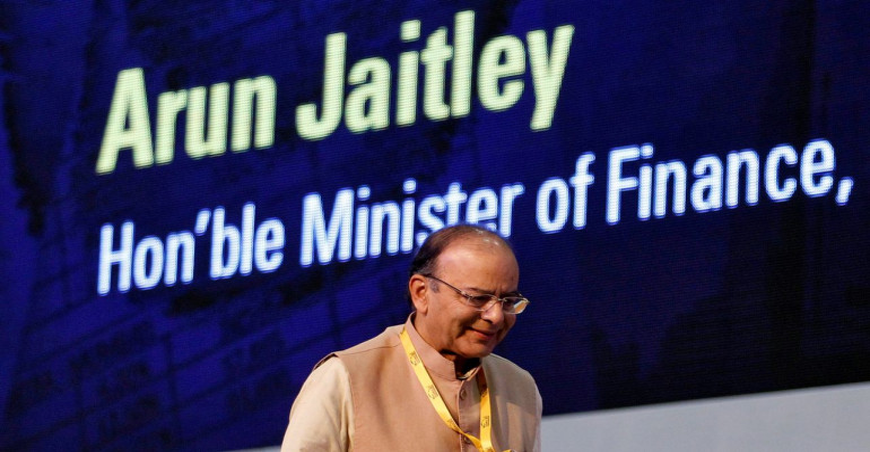

The Goods and Services Tax (GST) is on schedule for implementation from July 1 and will not lead to any significant increase in prices of goods although cost of some services may see a marginal hike, Finance Minister Arun Jaitley said today.

Hailed as the biggest tax reform since India’s independence, GST will replace an array of central and state levies with a national sales tax, thereby creating a single market and making it easier to do business in the country.

Addressing CII-Kotak investors’ round table here, Jaitley said that the GST Council, headed by him and comprising representatives of all states, will in the next few days finalise the rates of tax for different goods and services and the country is on track to roll out the simplified indirect tax regime from July 1.

“The current indirect tax structure in India is fairly complicated…those who transacted in either goods or services would have to deal with multiple authorities.

“The whole country was divided into multiple markets. So a free movement of goods and services was not possible. Now, the idea of GST was that let there be just one tax in the country,” Jaitley said.

He added that tax rates on goods may go down marginally under the new indirect tax regime while services may see some increase.

The GST Council, which had previously finalised a four- tier tax structure of 5, 12, 18 and 28 per cent, is scheduled to meet next week to put different commodities and services in the decided tax brackets.

Demerit and luxury goods will attract the peak tax rate plus a cess.

Tax rate closed to the existing incidence of total central and state levies will be chosen as the slab for a good or services.

“As far as goods is concerned, the tax is not likely to increase at all. If at all, it may marginally come down because of the cascading impact not being there and therefore, it is not likely to be inflationary.

“As far as services is concerned, obviously, they will go up marginally and therefore, there will be some impact on this. So, goods and services may react a little differently,” Jaitley said.

Asked if GST would stoke inflation, he said: “I don’t anticipate this to happen significantly. If at all, this may be a transient impact.”

At a separate interactive session on ‘India’s Business Environment: Reforms and Opportunities’ organised by CII, Indian Embassy and Japan Chamber of Commerce, he said after the Constitution was amended by Parliament and supporting legislations passed, state legislatures are approving the respective State GST law.

“Currently, that process is on. I see no difficulty in it,” he said adding GST rules have been framed and tax rates will be fixed at the GST Council meeting on May 18 and 19.

Jaitley sees no problems in rolling out GST from July 1.

“Hopefully, from July 1, one of the largest tax reforms in India since Independence — a simpler, more efficient and cleaner taxation system would be introduced in the country which itself would ease the very processes of doing business,” he said.

At the investors’ meet, he said there would be no cascading impact of tax on tax under GST.

“GST being a more efficient tax, evasion will become difficult. In the current system, there is large evasion,” he said.

Jaitley said the constitutional amendment gives time till September 15 for introduction of GST but the target date has been kept at July 1.

“So, we have a cushion of two-and-a-half months but it looks like we will be able to begin on schedule,” he said.

Also, a simple IT network has been put in place and there is no multiple forms for filing tax returns, he said.

GST would be a “transformational” system, he said, adding “there could be some small hiccups in the beginning but I think it’s understandable. We will be able to get over this”.

GST with a far more efficient system, Jaitley said, that will increase trade, tax collection and improve ease of doing business.

http://www.moneycontrol.com/news/business/economy/gst-scheduled-for-july-1-rollout-arun-jaitley-2273107.html