Category: GST

GST to be game changer for media, broadcasting

NEW DELHI: The GST Bill, among other new transformations, will prove to be a game changer for the media and entertainment industry, Union Minister Venkaiah Naidu said here today.

GST Bill to be tabled in Haryana Assembly today

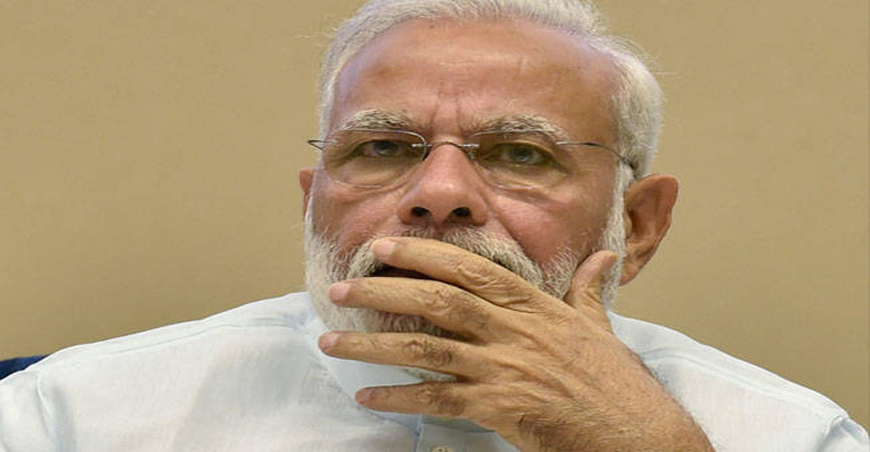

PM Narendra Modi takes stock of GST readiness, steps to check black money

NEW DELHI: Prime Minister Narendra Modi today took stock of the steps taken by the finance ministry for a smooth rollout of GST and anti-black money drive post note ban, among others.

UP Cabinet approves implementation of GST

LUCKNOW: The Uttar Pradesh government today approved implementation of the Goods and Services Tax (GST) in the state and the same will be passed in the Assembly in the session commencing from May 15.

GST not to increase compliance burden, says Hasmukh Adhia

NEW DELHI: The GST would not increase compliance burden on assessees and all apprehensions in this regard are misplaced, Revenue Secretary Hasmukh Adhia said today.

Govt under pressure to push GST rollout to September 1

Migration of assessees is behind schedule. Also, the IT infrastructure for GST by the GST Network is still being tested. It is very likely that States will seek more time for the introduction of GST, said two sources close to the development.

According to official data, barring the southern States, enrolment of businesses under GST continues to lag, with only about 70 per cent of them migrating as of the April 30 deadline.

Migration of service tax and Central excise assessees to GST was also low at 43.73 per cent and 24 per cent, respectively.

The issue is likely to be taken up at the GST Council meeting in Srinagar on May 18 and 19.

“Unless we have tested the GSTN how can we say we are ready? Then there are 14 draft GST rules in the public domain, which are yet to be finalised. We also have no clarity on whether new rules will come in or only 14 will be there. July 1 seems to be a very aggressive date for rollout,” Bimal Jain, Chairman, Indirect Taxes Committee, PHDCCI, said.

Finance Minister Arun Jaitley is keen on launching GST from July 1 and the Finance Ministry is making every effort to ensure this. The Ministry argues that a July 1 rollout of GST, which has been delayed by seven years, would mean it starts from the beginning of a new quarter.

“It could be an accounting headache for firms if GST started from September 1,” pointed out an official.

However, businesses, too, are getting anxious about the final rules and fitment of commodities. “Talks have only been taking place about goods; what about services? Here again there is no clarity,” Jain added.

“It will be a race to the finish. If the GST Council finalises the rates and rules in the May meeting, companies will still need some time to tune their systems. With the planned anti-profiteering authority, everyone wants to be very careful,” noted an industry representative, who did not wish to be named.

A committee of officers under the GST Council is finalising the exact rate on goods and services under GST in the 4-tier structure. “It would be good if the Council favourably considers the industry demand for a Sept 1 rollout. …several critical issues need to be clarified and product wise rates have not been released as well,” said Pratik Jain, Partner and Leader (Indirect Tax), PwC.

Sources said that another cause of concern in some quarters is the passage of the State GST Bills. Only five States have passed the SGST Bill, although the Finance Ministry expects all States to enact it by May

Petrol pumps selling non-oil products must enrol for GST: Adhia

“If petrol pump owners are selling other items like machine oil, then they will have to get enrolled for GST,” said Revenue Secretary Hasmukh Adhia in a Facebook Live session as part of the Finance Ministry’s awareness drive on the new tax regime. At present, petroleum products, including petrol, diesel, aviation turbine fuel, crude oil and natural gas, have been kept out of GST.

However, businesses with an annual turnover of up to ₹20 lakh will not have to register for GST or pay taxes.

The Revenue Secretary also said the Centre and States could at a later time choose to include petroleum products under GST, once revenue flows have stabilised.

“A large part of the income of States and the Centre comes for petroleum products,” he said, adding that States were concerned about a disruption in their income from these products under the new levy.

As much as 30-40 per cent of the income of States comes from potable alcohol and petroleum products.

Meanwhile, Adhia expressed confidence there would be no “tax terrorism” under GST.

“With the IT system of GST, taxpayers will not have to go to meet tax officials. We don’t want anyone to go to the tax department,” he assured, promising that there would be minimum interface with tax officials as long as assessees file their returns honestly.

He pointed out that both filing of returns as well as claims for refunds would be online under GST.

Only 34% service taxpayers move to GST Network, CBEC ups outreach

NEW DELHI: The revenue department is stepping up its outreach programme, asking taxpayers to register with the GST Network by this month-end as only 34 per cent of the existing service tax assessees have so far migrated to the new payment portal.

GST to push Indian growth to over 8%: IMF

The ambitious Goods and Services Tax (GST) to be implemented from July 1 would help raise India’s medium-term growth to above eight per cent, the International Monetary Fund has said adding that the reforms being done is expected to pay off in terms of higher growth in the future.