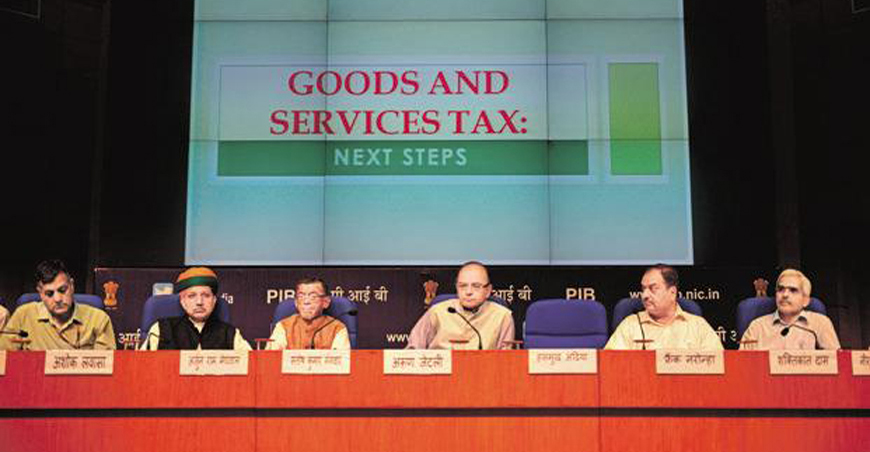

NAGPUR: Though India has made rapid progress in utilization of modern technology, a lot more is needed to be done on this front so as to give economy a boost. Implementation of the Goods and Services Tax (GST) from next year will also help bring about all-round development of the country as it will generate more revenue, said MS Unnikrishnan, managing director and chief executive officer of Thermax Ltd, on Thursday.

Addressing aspiring entrepreneurs at Vidarbha Industries Association, Civil Lines, Unnikrishnan said that science creates technology which, in turn, creates commerce.

He said, “India is lagging behind when it came to creating new technology as we are losing out on a lot of opportunities to help the economy grow. We must think differently from what we have been till now. There are many opportunities that can be exploited if we are a little creative with our ideas,” he said.

He urged the start-ups to capitalize on technology to fill the void in industries. Taking his point forward, he elaborated on the concept of hydroponic farming, a method of growing crops without soil. The time has come to use water soluble nutrients and minerals which are required for terrestrial plants. He said that this method of farming will alleviate space on land as hydroponic plantations could be housed in multistorey buildings also. Financial aides like loan waivers and subsidies also add significantly to the annual expenditure, he said.

He added that such expenses may not be necessary in the future if the government provided proper skill training to people which in turn will boost innovation and propel business.

Unnikrishnan explained the nature of India’s economy which, according to him, is consumer-based.

“Most of what we manufacture here is consumed. What remains is exported,” he said, adding that the country is growing as a manufacturing base of the world and it will not be long before it overtakes China in production.

Unnikrishnan opined that demonetisation was a good move by the government. However, its implementation could have been better. Earlier, the government had printed notes in excess which became a new method of hoarding wealth after gold and land. He said, “The person who thought that Rs500 and Rs1,000 notes should be demonetised wanted to do good for the country.” He said that if notes are printed in surplus, it will lead to grave consequences.

According to Unnikrishnan, the government has a grand plan to cleanse the economy of which demonetisation was a part. With the implementation of GST from next year, the economy is likely to see increased growth.

“The government does not have a lot of money at the moment,” claimed Unnikrishnan. For every Rs100 we earn, we pay Rs8 in taxes, which is far less than figures in developed nations, he added. The government’s intention to link transactions with Aaadhaar card and digitisation will bring transparency in the system, Unnikrishnan added.

“Generating revenue through taxes is the only way the government can get money to build infrastructure which supports the economy,” he said.

These major changes in finance will create a lot of opportunities for businesses to flourish. The ecosystem for manufacturing is also evolving in Vidarbha, said Unnikrishnan.